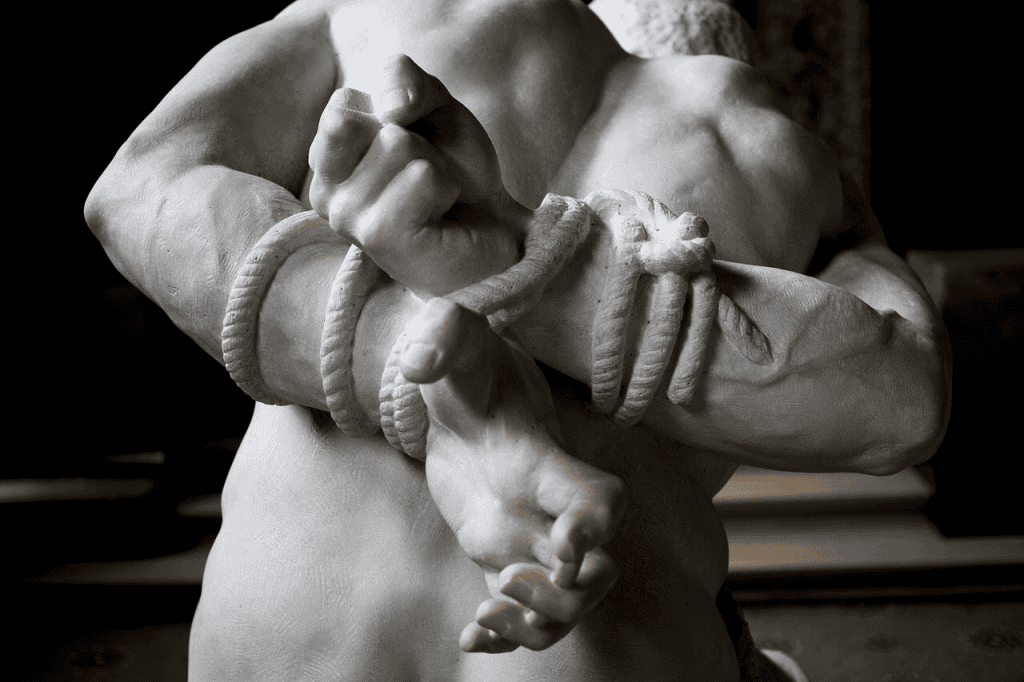

Kidnappers use ransoms to raise capital.

battleface’s Kidnap and Ransom (K&R) insurance protects travellers in high-risk areas around the world in the event of kidnap, extortion, wrongful detention, and hijacking.

Numerous criminal elements have jumped onto the bandwagon to make quick money.

The money generated by these criminal gangs fund arms procurement and other criminal activities.

Somali piracy alone generates millions in annual premiums. Nigerian and Nicaraguan abductions for profit have soared, and when the Algerian gas plant was taken hostage, with it’s hundreds of workers, insurers were inundated with calls.

An increasing number of big high-flying companies have Kidnap & Ransom coverage for their staff nowadays. Plan options include Ransom cover, hiring negotiators and consultants, loss of earnings and other costs. The market has increased from about 250 million dollars in 2006 to 500 million dollars in 2011.

A new business model

Today business is changing and shifting, Somali piracy has declined, there have not been any documented hijackings since 2012, And although the number of attacks in the Gulf of Guinea overtook those of the East Africa in 2012, quieter shipping routes there mean fewer potential customers, yet new markets are opening up. In Africa, India and Latin America the middle class has been growing and so has the worry about being kidnapped. For instance, “express” kidnappings are on the rise, negotiators report. This quicker version involves fast, targeted grabs, followed by shorter periods of detention and smaller ransoms.

Negotiation firms say the most serious cases of kidnapping seem to be getting more protracted, and hardened kidnappers more patient. Trends such as Chinese energy firms moving into West Africa add to the business kidnap & Ransom firms can chase. To set themselves apart, some are offering “added value,” often aimed at reducing the risk of a kidnapping in the first place. By training clients to avoid trouble, and helping them out when they smell danger, insurers can cut pay-outs. Such measures not only ensure that clients get home in one piece, but lower premiums. Governments are fans, too: at the G8 meeting in mid-June, ministers agreed to crack down on the payment of ransoms to terrorists, urging insurers and clients to adopt “good practices” for kidnap prevention.

How it works

If a customer is on business in Libya or Nigeria, they will be given advice before they leave. If he or she senses trouble brewing while they are abroad, they can call the number. The team there will then use a network of “black book” contacts, including private security firms, to reach the client in danger. If plans fail and the customer is nabbed, negotiators will step in. Around 60 kidnaps per year will be run from the new facility. Extortion and medical evacuation are other orders of business.

Latin American kidnappers are getting better at choosing their victims, using intelligence gathered from social media platforms and other sources. Criminals who have done their homework tend to pick better targets, choosing those with families or employers who have access to ready cash. Smaller gangs, keen to join in, are learning the tricks of the trade. Insurance alone does not reduce the chance of being kidnapped, kidnappers will target those with K&R cover. But with preparation, and a helping hand when things go wrong, just might improve the chance of getting out alive.