Table of Contents

The travel insurance landscape is evolving rapidly – and these trends will reshape how you serve your customers.

The travel insurance industry has witnessed significant changes in 2025, with new battleface data revealing shifts in consumer behavior, pricing strategies, and coverage preferences. For travel professionals, understanding these travel insurance trends isn’t just beneficial – it’s essential for staying competitive and meeting evolving customer expectations.

Our comprehensive analysis of US single-trip travel insurance policies from April through June 2025 compared to the same period in 2024 reveals surprising patterns that travel industry professionals should understand.

Health-First Mentality Drives Medical Coverage Surge

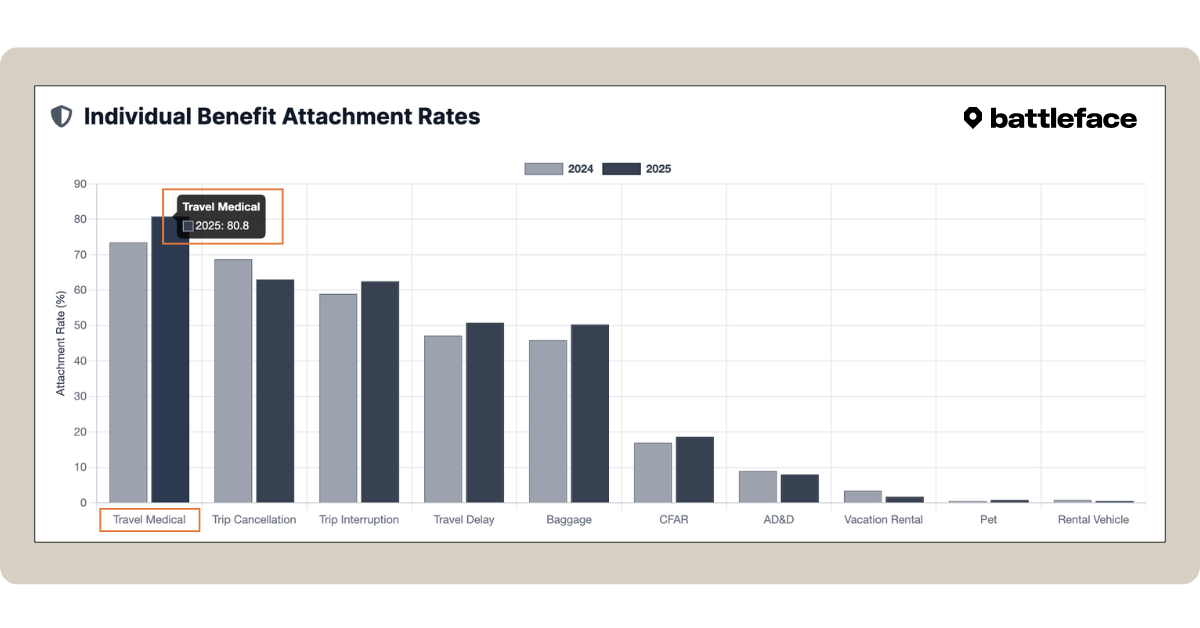

The most striking trend in 2025 travel insurance data is the increase in travel medical coverage adoption. Medical insurance attachment rates jumped from 73.5% to 80.8% – a significant 7.3 percentage point increase that signals a fundamental shift in traveler priorities.

This surge reflects travelers’ heightened awareness of health risks when traveling abroad. Post-pandemic, customers are no longer viewing medical coverage as optional; they’re treating it as essential protection. For travel agents and tour operators in particular, this presents a clear opportunity to lead conversations about comprehensive health protection rather than waiting for customers to ask.

The data also shows that travelers are willing to invest more in medical coverage, with the average gross written premium per insured person increasing by 8.6% to $123.78. This willingness to pay premium prices for health-related coverage suggests that quality medical benefits should be positioned as standard rather than add-on options.

The Rise of Selective Coverage Strategies

Perhaps the most significant behavioral shift in 2025 is travelers’ move toward selective, targeted coverage rather than comprehensive packages. The data shows a substantial increase in customers choosing 1-2 benefit bundles, jumping from 27.2% to 35.8% of battleface DTC Discovery purchases.

This trend indicates that today’s travelers are more informed and deliberate about their insurance choices. They’re researching specific risks related to their trips and purchasing targeted protection rather than accepting default comprehensive packages. The “one-size-fits-all” approach is proving to give way to customized coverage strategies.

Interestingly, while selective purchasing increased, the Travel Medical + Trip Interruption + Trip Delay + Baggage Protection bundle saw explosive growth of 369%, rising from 1.9% to 8.9% of purchases. This specific combination appears to hit the sweet spot for many travelers – providing essential health protection while covering the most common travel disruptions.

Revenue Growth Despite Selective Purchasing

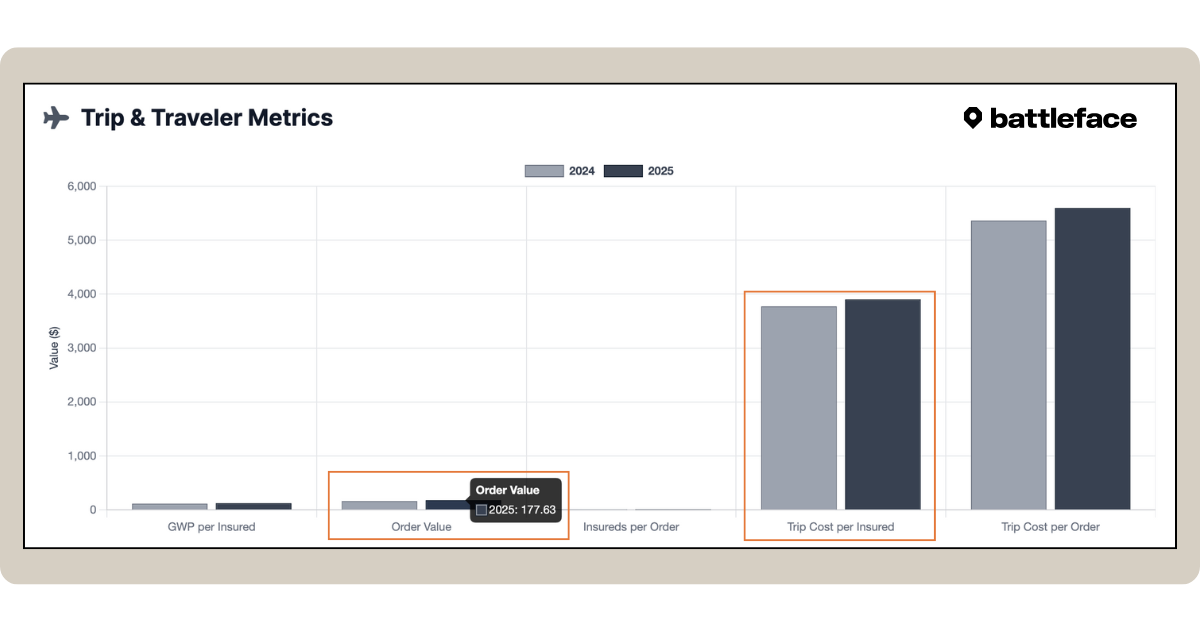

Despite travelers becoming more selective about coverage, battleface DTC Discovery has shown organic growth. Average order values increased by 9.7% to $177.63, while trip costs per insured person rose a modest 3.4% to $3,902.

This disparity suggests that insurance pricing is outpacing trip cost inflation, potentially reflecting either improved coverage quality or market pricing power. For travel professionals, this trend indicates that customers are willing to invest more in insurance relative to their total trip costs, presenting opportunities for higher-margin insurance sales.

The stability in average insureds per order (maintaining around 1.42-1.43 people per policy) suggests that group travel patterns haven’t significantly changed, but per-person insurance spending has increased, again despite being more selective in coverage choices.

Strategic Implications for Travel Professionals

These travel insurance trends present several key opportunities for travel industry professionals:

- Lead with Health Protection: Given the surge in medical coverage adoption, position travel medical insurance as a standard component of any international trip, not an optional add-on. Customers are clearly prioritizing health protection and are willing to pay for quality coverage.

- Embrace Consultative Selling: The shift toward selective coverage means customers want guidance on choosing the right combination of benefits. Travel professionals who can educate clients about specific risks and appropriate coverage will differentiate themselves from competitors.

- Highlight Targeted Bundles: The success of the Medical/Interruption/Delay/Baggage combination suggests that pre-configured bundles addressing specific traveler profiles could be highly effective. Consider developing signature insurance packages for different trip types or traveler demographics.

Looking Ahead: Positioning for Success

battleface U.S. single-trip buying behavior suggests the travel insurance market’s evolution in 2025 reflecting broader changes in how travelers think about risk, value, and protection. Customers are becoming more sophisticated in their insurance choices while simultaneously prioritizing health-related coverage.

For travel professionals, success will increasingly depend on your ability to navigate these trends effectively. Those who can articulate the value of targeted coverage, lead with health protection, and guide customers through selective purchasing decisions will build stronger client relationships and drive higher revenue per customer.

Our data clearly shows that travelers are willing to invest more in trip protection when they understand the value and relevance to their specific needs. By staying informed about these travel insurance trends and adapting your approach accordingly, you’ll be well-positioned to serve your customers better while growing your business in an evolving market.