Table of Contents

Winter has officially arrived Down Under, and the latest travel insurance data reveals some fascinating insights about where Aussies are heading to escape the cold.

Our comprehensive analysis of policy data with purchases made between 1 June and 25 June comparing 2024 and 2025, uncovers interesting shifts in Australia winter travel trends that will reshape how travel professionals approach this crucial season.

Domestic Travel Within Australia is More Popular This Year

The most striking revelation from our data? Domestic coverage has more than doubled based on percent of total policies. Interestingly enough, domestic travel wouldn’t have even made the top 10 in June 2024. But now, in June 2025, Aussies have opted to stay closer to home, with domestic policies now climbing to the #4 spot to start the busy winter travel season.

“We’re seeing Aussies rediscover their own backyard,” explains the data trend. While international coverage still dominates at over 91% of total policies, the domestic surge suggests that Australian winter destinations are finally getting the recognition they deserve. From Queensland’s eternal sunshine to Western Australia’s mild winters, Australians are choosing to stay closer to home.

Travel Declines to Indonesia (But is Still Holds the #1 Spot Aussies)

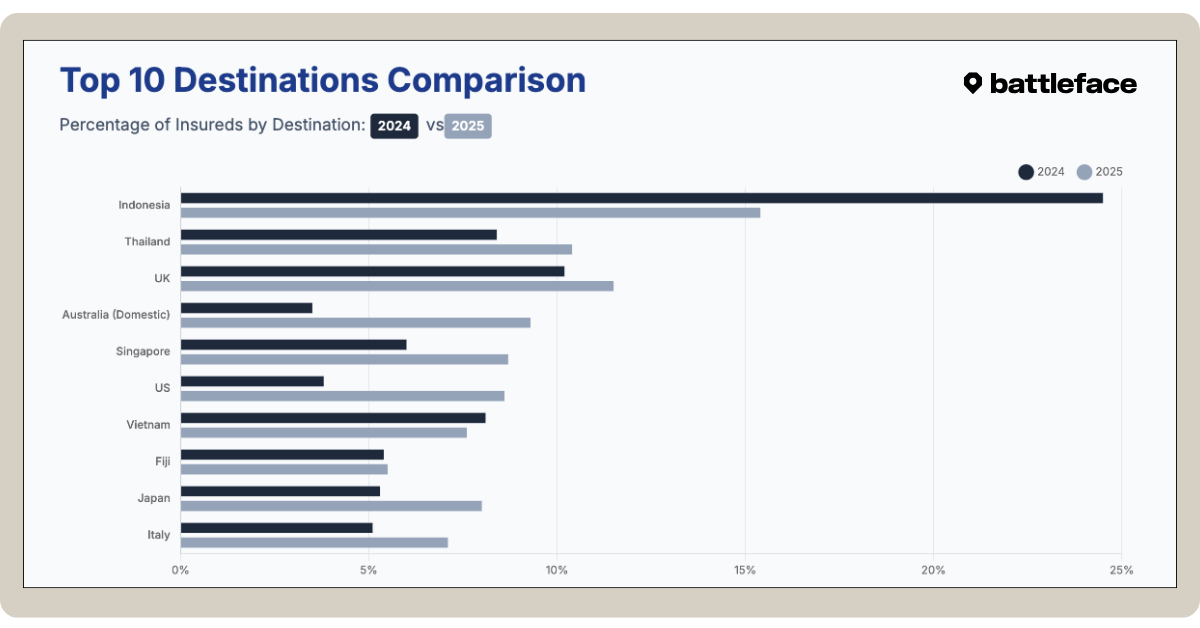

Indonesia’s market share (based on early winter travel trends in June) plummeted by -37.1%, dropping from 24.5% to 15.4% of all policies. It’s likely due to the recent volcanic activity taking place in the region—but nonetheless, it remains in the #1 position as the most sought after country for overseas Australian travellers.

The winners in this destination lottery? While Indonesia remains the most travelled to destination for Aussies, it did decline significantly year-over-year. The two international destinations with the most significant growth were the US and Singapore. Trips to the US grew by +126% and Singapore by +45%.

Warmer climates aside, both countries offer robust and diverse opportunities to enjoy a change of scenery during the Australian winter months.

Honorable Mention: Thailand and the UK

Thailand remains a prominent holiday location, and not only has it grown year-over-year as a top tourist destination, it holds the #3 spot for Aussies to start the winter travel season.

For the second year in a row, the UK remains the #2 ranked destination for overseas travel, based on its selection by Australian policyholders in June 2025. While the flight might be long, there is not a shortage of things to do and places to see during the warmer summer months in the UK.

The Changing Face of Australian Travellers

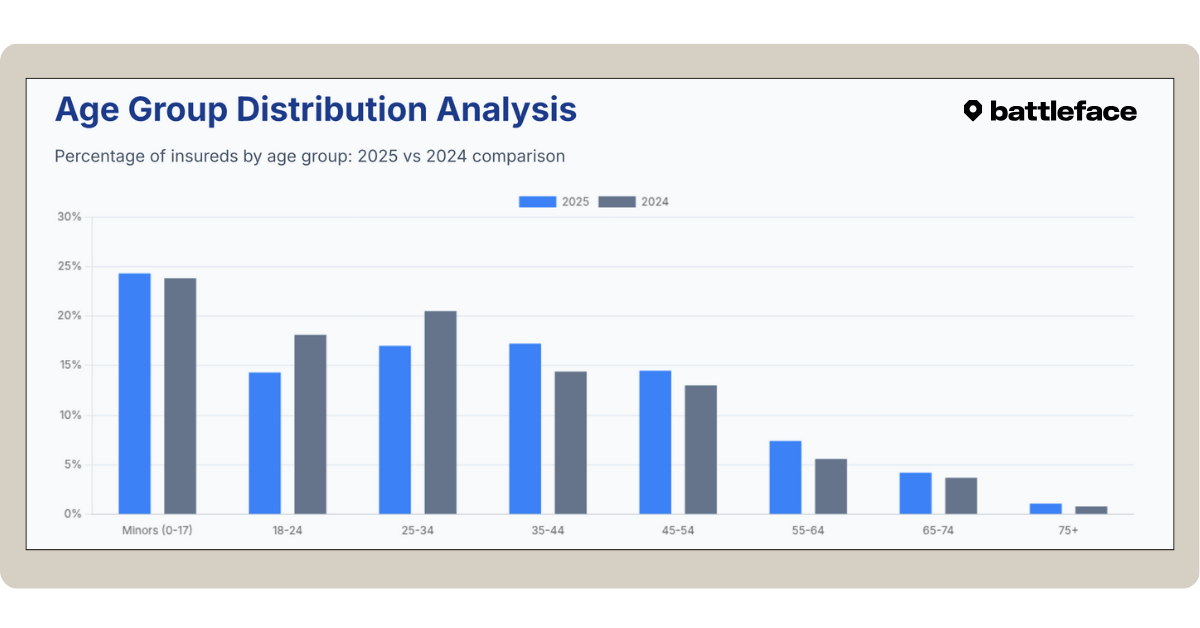

The demographic data reveals intriguing shifts in Australia travel insurance trends. While families with minors continue to represent the largest segment at 24.3%, there’s been a significant evolution in age group preferences.

Older Australians are embracing winter travel like never before. The 55-64 age group surged by 32.1%, while the 35-44 demographic grew by 19.4%. Conversely, the traditional backpacker demographic (18-24) declined by 21.0%, suggesting a maturation of the Australian winter travel market.

This demographic shift has profound implications for travel professionals. Mature travellers typically seek premium experiences, longer stays, and comprehensive coverage. This appears inconsistent with what our June policy data is telling us, with increased domestic travel and shortened trip duration compared to the previous two years in 2024 and 2023.

Buyer Behaviour Shifts: More Lead Time, Shorter Trip Duration

Two notable buying behaviour shifts have occurred to kickoff the busy winter travel season in Australia:

- Travellers are purchasing policies with more lead time before their scheduled departure date.

- Travellers are booking shorter trips when compared to June 2024 and June 2023.

The shortened durations, as a result, have decreased the amount Australians are paying for travel insurance – average order values have decreased by -15.3% (from $213.64 to $180.95).

Average GWP per insured has also declined by -5.7% to $80.78, suggesting competitive pricing pressures in the market. For distribution partners, this trend highlights the importance of value-driven propositions and innovative packaging strategies.

4 Strategic Opportunities for Travel Professionals

The data presents several key opportunities for Australian travel industry partners:

Domestic Market Expansion.

With domestic travel surging 165.7%, there’s unprecedented opportunity to develop specialised winter packages for Australian destinations. Think Northern Territory’s dry season, Queensland’s tropical warmth, or Western Australia’s mild winters.

Mature Market Focus.

The growth in 35+ demographics suggests premium product opportunities. Longer trips, higher-quality accommodations, and comprehensive coverage packages align with this demographic’s preferences.

Destination Diversification.

Indonesia’s decline creates space for emerging destinations. Thailand’s growth proves Aussies are open to new experiences, while the USA surge suggests appetite for long-haul premium travel.

Timeliness of Travel Insurance Offer.

With the recent trend of Aussies buying cover with more lead time prior to trip departure date, this suggests a strategic need to present an offer for cover earlier in the value chain.

Summary: Winter Travel Trends 2025

The 2025 Australian winter travel landscape is characterised by domestic discovery, demographic maturation, and destination diversification. Travel professionals who recognise these shifts and adapt their strategies accordingly will be best positioned to capitalise on this evolving market.

Whether it’s developing domestic winter packages, targeting mature demographics, or exploring emerging international destinations, the data provides a clear roadmap for success in Australia’s changing travel market.

This analysis is based on comprehensive data from anonymised policyholder information specific to the battleface Australian market. The specific timeframe analysed was the first official month of Australia’s winter season between June 1-25 from 2025 and 2024.