Who We Partner With: Global Distribution Channels

Partner Channels: Choose Your Journey

Click the button of the channel most relevant to you, or, continue scrolling to take your own self-guided tour.

Don’t see your specific channel listed as an option? No worries. Select the “other” option to view a condensed list of additional segments.

Partner FAQ (Frequently Asked Questions)

What is battleface most known for?

Our name alone makes us stand out – but name aside, product customization, benefit modularity, and obsession over customer experience are what sets us apart and what we’re most widely known for in the industry.

Which areas of the business does battleface outsource?

None. While we have strategic partnerships with outside insurance carriers and reinsurers, every aspect of our business model is managed 100% in-house.

Does battleface sell travel insurance policies direct to consumers?

While we do have a DTC (direct-to-consumer) channel for policy distribution, we use this channel as a strategic advantage to benefit our partners. We see our DTC channel as a sandbox type of environment to test and experiment to pass key insights along to our other distribution partners.

What does your partner implementation process look like?

This will depend on the specific partner. However, once a contract is dually signed, we act fast to align internally across our product, implementation, and engineering teams to begin gathering business requirements and scope of work aligned with the proposed and agreed upon go live date with the partner.

Online Travel Agency (OTA)

How we partner with OTAs

Over the last couple of years, we’ve partnered with a variety of OTAs across the globe to help them solve for one of two problems:

Diminishing attachment rates from an existing travel protection offer.

Diversifying product offerings by testing alternative options.

Our unique process: how we work with OTAs

Address existing challenges.

First and foremost, we listen. We listen to fully understand the scope of challenges facing their business.

Data sharing.

We cannot act on instincts alone. Upon learning the challenges and problems facing the OTA, we seek to better understand data and insights prior to proposing solution options.

Internal cross-department review of challenges and data to propose solutions.

Internally, we get input from experts in various departments to explore comprehensive solutions to propose back to the OTA partner.

Present a plan proposal back to the OTA partner for discussion and review.

One of our unique value propositions is speed to market, but that also applies to our processing speed to arrive at solutions to the OTA’s challenges.

Allow for the OTA to digest the solutions presented and come up with a go forward plan.

It’s possible that what we propose may take some time to digest and get internal approval to proceed and prioritize on the product roadmap.

Managing General Agency (MGA)

How we partner with MGAs

While MGA partners can work directly with carriers, they (MGAs) often prefer to work directly with us – primarily because of the uniqueness of our filings with the carriers we work with.

We currently work with several MGAs across the U.S. and Australia, with our single trip modular plan design and annual multi-trip policies leading the way in popularity among MGA partners.

How MGA partners benefit from working directly with battleface

End-to-end policy administration and customer servicing.

Once the MGA partner is setup and implemented on their website, the combination of battleface and Robin Assist take it from there – literally. We collectively manage all aspects of the customer experience, including customer service, travel assistance services, and claims submission and processing, after the policy has been issued.

Seamless tech integration via custom product API.

Once the exact product specifications have been decided, we get to work creating custom APIs for your team to use to develop the frontend UX/UI buying experience from your e-commerce.

battleface handles and manages the compliance review and approval process.

MGA marketing teams will appreciate this one. Because we work directly with the carriers, our internal compliance team reviews verbiage. Best of all? Our compliance turnaround time is typically 2-3 days or less.

The MGA decides how to handle policy fulfillment.

Do you have a robust CRM solution tied into your e-commerce platform already? That’s great! We can work with your tech and CRM teams to ensure the proper triggers are set up for your system to generate fulfillment emails. (We can also handle this for you if preferred using your brand guidelines!)

Our tech and APIs allow for swift changes to benefits and/or benefit levels.

That is the beauty of benefit modularity combined with innovative tech. Are your customers asking for a benefit or benefit limit that’s not being offered? Fortunately, we can work with you to make the changes, assuming they fall within our compliance and underwriting guidelines, of course!

Let's pause for a brief commercial break

Create New Travel Protection Plans Your Customers Will Actually Like

We’ll help you design one of a kind micro products, uniquely tailored for how your customers travel, backed by 24/7/365 global assistance services.

The perfect combination of winning at attachment and extending lifetime value.

Let’s talk more about your business model and how you (and your customers) will benefit from a new kind of trip coverage.

Request a Call

Reach out to our partnerships team to schedule some time for a quick, no obligation discovery call.

"*" indicates required fields

TravelTech Partnerships

How we partner with TravelTech companies

Travel technology, in a lot of cases, powers the travel industry. Some work behind the scenes while others are more customer facing.

Regardless, this partnership channel at battleface has gained a lot of momentum since mid-2023. Specifically, with TravelTech companies that have a multi-regional footprint.

Why does the battleface model work well TravelTech partners?

Tech forward travel meets tech forward insurance solutions.

Through custom API development, we integrate with TravelTech companies to embed or white label travel insurance plans to offer to its end consumers or for its other B2B partners for alternative distribution. All of which ties back to our one tech platform policy administration system for full policy lifecycle management.

When multi-regional TravelTech companies need a global insurance solution, they turn to battleface.

Our global reach and strategic carrier partnerships in the U.S., Canada, UK, EU, and Australia enable us to underwrite plans in prominent markets where travel insurance is in high demand. All backed by the global reach of our customer service and travel assistance and claims operation, Robin Assist.

Adaptability to consumer preferences of travel insurance benefits.

Our insights and underwriting teams keep a close watch on the ever-changing shifts in consumer buying behavior. As a result, this allows us to be proactive in recommending policy benefit changes to align with those needs to optimize for attachment.

As your business grows, we grow with you.

As your building your TravelTech business by acquiring new partners, our technology, products, and services are capable of supporting new opportunities to distribute travel insurance and assistance services from us, through you, and to them.

By merging battleface’s tech-first approach with our expansive reach worldwide, we are building a unified platform that will greatly enhance the customer experience, making travel insurance more relevant, seamless, and effective for the modern traveller.

- Chief Product and New Business Officer at HBX Group

Travel Management Companies

How we partner with TMCs

Similar to TravelTech companies, we work with travel management companies on discovering the right product to distribute through its (the partner’s) tech and made available for distribution through affiliated partnerships and/or directly to the end users.

The products available to support TMCs include Annual Business Travel Insurance, Corporate Group Travel Insurance, Single Trip (Comprehensive) Travel Insurance, Multi Trip Annual plans, or a custom CLIP.

What types of challenges do TMCs face and how could battleface help?

Challenge 1: Fragmented customer experience between insurance, customer service, assistance, and claims.

We often hear about TMCs using one administrator for distributing insurance and another company for managing travel assistance and/or claims. This type of situation is very common and can lead to customer confusion and frustration, especially during times when they help the most.

At battleface, we diversified early in 2023 to provide TMCs, and all distribution partners alike, a one-stop-shop for travel insurance products, customer service, travel assistance and emergency evacuation services, and claims administration. The ability to manage the full lifecycle of a policy from creation, issuance, to servicing positioned us as an ideal partner for global TMC brands.

Challenge 2: Distributing insurance globally in multiple currencies and/or multiple languages.

Most of the largest TMCs in the world have global infrastructure and operations. From an insurance perspective, partnering with TMCs with global reach can be complex. With battleface, we do our best to make the process as smooth as possible that is within our control. But our global, one tech platform solution for full policy lifecycle management comes equipped with dynamic APIs that allow for currency and language customization, applicable by region and subject to product availability.

Challenge 3: Lack of flexibility in benefits to cater towards both business and leisure.

Providing our TMC partners a hyper-relevant suite of product options to offer their partners and/or travelers is a significant strategic advantage in a market full of boring plans packed with the same standard benefits.

Insurance Comparison Websites

How we partner with comparison sites

Consumer preferences and sentiment towards comparing insurance products online has evolved in a positive and strong direction. One notable differentiating factor … research.

With embedded and affiliate partners, in most cases, customers see one product option and it’s generally at the point of purchase for another transaction.

With comparison sites, customers are afforded the opportunity to compare, research, and choose.

Offer flexibility: how our product API structure sets up apart with comparison sites

Custom benefit package selection (not available in all regions)

Our two largest regions for comparison site partnerships are the U.S. and Australia, mainly due to the heightened popularity and customer demand. In most cases, battleface can tailor specific benefit packages only available on the (comparison) partner’s website. In most cases, we’ve found the limitations in product configuration come from the partner’s side, but the options for in-depth product customization are there, assuming the partner has adequate technical resources to accommodate.

Software development kit (SDK) equipped with all available and relevant API

We’ve found in recent the years the best comparison site partnerships are equipped with highly technical teams who prefer an SDK type of approach for integration and implementation. For battleface, our product and engineering teams can seamlessly create a custom SDK that is easily adaptable and flexible based on the uniquely needs of the comparison site’s technical setup for API and other file ingest processes.

Accelerated speed to market

As a tech-forward company ourselves, we recognize and appreciate the need for a comprehensive product roadmap designed to optimize for revenue generation and operational efficiency. The beauty of our partnership approach lies in simplicity in API design, but a lot of times implementation gets held up on the partner side due to internal priorities. We get it! But partners can rest assured we will never be a bottleneck to launch.

Let’s build the future of travel protection together

Recent industry reports suggest a rise in consumer travel but a decline in travel protection attachment.

We’re helping solve for this one partnership at a time with more product relevance and exceeding customers’ expectations with duty of care and service.

Let’s talk more about your business model and how you (and your customers) will benefit from a new kind of trip coverage.

Request a Call

Reach out to our partnerships team to schedule some time for a quick, no obligation discovery call.

"*" indicates required fields

Events and Registrations

Seasonal sports registration and event ticketing and partnerships

Providing event and registration companies the flexibility to offer single event or annual registration protection has become commonplace as the need for seamless tech integration has proven to be paramount in insurance partner selection.

With our modular benefit design, selecting only the benefits that matter most has proven to be the most effective means to create value with event and registration customers.

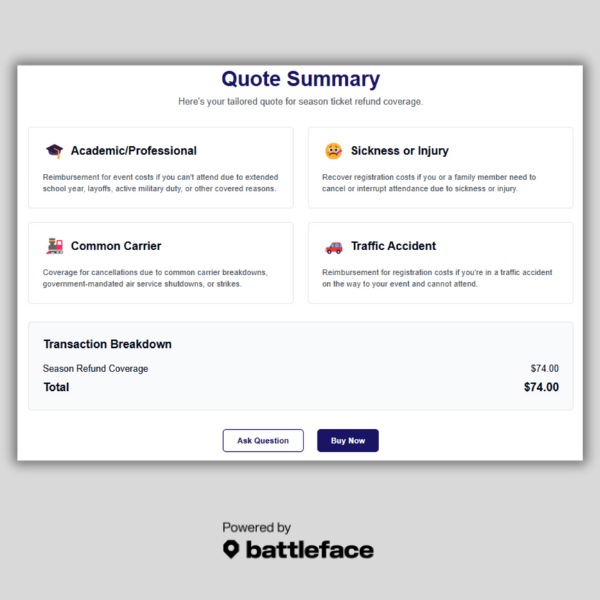

Partner case study: providing embedded coverage to seasonal sports registration at scale

Situation: one centralized platform, thousands of local youth sports organizations.

In the U.S. market, youth sports organizations at the local level have become increasingly more prominent. And parents have been taking these sporting activities for their children very seriously.

One software company set out to simplify the signup process and onboarding thousands of local youth sports organizations to its platform. But they did not have a solution to offer parents (registering on behalf of their children) for protection against interruptions during the sporting season.

Challenge: integrating an offer within the platform accessible to each organization.

We worked with the partner first on crafting the adequate product offering inclusive of benefits that aligned with travel sports. Next, we had to work through the design thinking process to integrate the offer in a way that was accessible to these local organizations to enable as part of their unique online signup process.

Outcome: enable organizations to enroll to embed the coverage offer with one click.

Once successfully integrated, the partner rolled it out broadly to its existing customer based of local youth sports organizations. Now, these local organizations can seamlessly activate the offer through its specific process allowing for parent/child opt in as part of the signup process.

What is the battleface difference?

We help companies across the globe add more value to their travelers’ experience with hyper-relevant travel protection backed by second to none customer service during all phases of travel. We’re your next partnership that will help you add or increase ancillary revenue and amplify lifetime value with your customers.

Airlines, Hotels, and Hospitality

How airlines, hotels, and vacation rental companies can drastically improve travel insurance opt in

The ubiquity of embedded travel protection offers among large travel companies is no secret to anyone in the travel industry.

What is lesser known is the stagnation of consumers opting in at the point of purchase. It’s a problem, but more importantly, we have proven solutions.

5-step process for improving embedded travel insurance attachment

Step 1: Deep customer research on historical trip bookings to create audience cohort segments.

Access to traveler data for airlines, hotels, OTAs, and vacation rental companies is vast and significant, but when it comes to using it for the benefit of embedding an travel protection offer, there has been an historic missed opportunity.

If we’ve learned anything over the years at battleface, it’s understanding travelers’ unique and specific needs and preferences is paramount to optimizing for attachment.

It’s highly likely travel companies already have a sophisticated arrangement of known traveler profiles. Now they just need to put them to use to drive increased attachment and ancillary revenue.

Step 2: Unify cohorts with trip commonalities associated to relevant insurance benefits.

From an airline perspective, to use as an example for step 2, start simple with a proof of concept to eventually get more complex. Here are a few cohort examples to get you started:

- Solo traveler | domestic round trip | refundable rate | economy | no checked luggage

- Solo traveler | international round trip | non-refundable rate | economy | has checked luggage

- Two travelers | domestic one-way | refundable rate | first class | no checked luggage

The question now becomes: how do you align specific benefits for these cohorts to make the protection bundle as relevant as possible?

First, you need to start with a couple base plan benefits that would be relevant regardless of the trip and traveler type. For air travel, consider travel inconvenience benefits like trip interruption and travel delay as two base benefits to build on.

Here are a few if/than benefit trigger examples to consider adding onto the base benefits for maximum relevancy:

- Domestic trip = do not add travel medical expense benefit … International trip = DO add travel medical benefit

- Refundable rate = do not add trip cancellation benefit … Non-refundable rate = DO add trip cancellation benefit

- No check bags = do not add baggage protection … Has checked bags = DO add baggage protection

- First class = DO add trip cancellation ONLY if a non-refundable airfare rate was selected

Step 3: Create custom benefit bundles (with battleface) and redesign frontend offer UX.

Using the high-level and simplified trip/traveler cohort examples with the proposed base benefits, let’s put these benefit bundles together:

- Solo traveler | domestic round trip | refundable rate | economy | no checked luggage = Protection benefits: trip interruption and travel delay (base only)

- Solo traveler | international round trip | non-refundable rate | economy | has checked luggage = Protection benefits: base plus trip cancellation, baggage protection, and travel medical expenses (5 total benefits)

- Two travelers | domestic one-way | refundable rate | first class | no checked luggage = Protection benefits: base plus trip cancellation (3 total benefits)

Dynamic benefit placement for embedded in (booking) path trip protection offers, with layered in social proof and trust signal messaging, is your pathway to optimizing for attachment.

Step 4: Sign-off on final designs and approve language, etc. through compliance and legal.

At this stage of the process, finalizing the frontend UX/UI design to be flexible to adapt to the product variability, inclusive of necessary notices and disclosures vetted by compliance and legal departments, becomes the final step before handing over to development teams.

This phase typically becomes the most complex as more “chefs enter the kitchen.” Most importantly, however, is conducting preliminary UAT (User Acceptance Testing) to ensure all aspects of the design exceed the expectations of the end users. This can begin as an internal exercise, but it is advisable to extend this phase to a cohort of actual customers.

Step 5: Ship to engineering from API configuring and programmatic package offer to specific cohorts.

Software developers and engineers hate to hear this, but in most cases, they are not visual designers. So it’s vitally important to be very prescriptive within the requirements. As Steve Jobs once famously said, “We’re designing products for the customer. We must not start with the technology first and work our way backends to the design.”

There will likely be some added complexities in the logic behind configuring the benefit API to specific trip and traveler details entered during the booking process. This is why the first phase should be simplified down to easy to ingest and understand cohorts as a proof of concept to expand into more complex booking scenarios.

Specialty Travel Companies

Specialty travel companies are in abundance, all working to own a specific niche in the market

Since launching in the UK market in 2018 as a specialty travel company ourselves, we relate very well with other specialty travel and tourism companies aspiring to carve out their specific territory in the market.

One longstanding partnership of our’s embodies the perfect case study for bringing a vision to life to add value to both travelers, the partner, and … dogs.

Partner case study: providing customized embedded products to people traveling with pets

Situation: partner needed a highly specialized product relevant to travelers bringing their pets on trips.

People love their pets. We also love pets at battleface, so when this partner came to us for help ensuring travelers could add protection for their pets while traveling, we absolutely wanted to help.

This of course was enabled by our U.S. insurance filing in partnership with Spinnaker and Everspan where we unbundled benefits making them modular. And once we did that, our diverse tech team enabled individual benefit API accessible by partners.

For this specific partnership, we needed to create a custom offering that included both standard travel protection benefits (for humans) and pet-specific benefits for their non-human travel companion.

Challenge: ensuring positive take rates during the booking process whilst offering two separate plans.

During the product design phase, we ended up splitting the offer into two separate plans to be offered at the same time embedded in the booking path.

The reason behind this was to give the customer a choice between only protecting the whole trip, only protecting the travelling pet(s), or selecting both.

We generally don’t advise on presenting multiple offers. But in this case, it made sense.

Outcome: doubled product attachment rate compared to previously offered plan.

The end result? Well, not technically the end because this partner continues to have high attachment rates, but from switching the embedded offer strategy, attachment jumped from 15% up to an average of 35%.

When working with partners, we generally err on the side of caution when forecasting projected offer attach rates as to not over promise on results. Our standard baseline is 20-25%, but as we can see from this use case, developing a more hyper-relevant product offering can yield a much better outcome.

Other Distribution Channels Not Listed Above

Did we forget about you? Not to worry; we also work with a host of other partners across other distribution channels.

Here’s a consolidated short-list of others we actively work with to build the future of travel protection:

- Tour Operators

- FinTech

- Travel Agencies

- Host Agencies

- Group Travel Organizations

- Student and Study Abroad Organizations

- Colleges and Universities

- Brokers

- Carriers

- Adventure Travel Organizations

- NGOs and Non-Profit Organizations

Contact our partnerships team directly at [email protected] to learn more.

Let’s build the future of travel protection together

Recent industry reports suggest a rise in consumer travel but a decline in travel protection attachment.

We’re helping solve for this one partnership at a time with more product relevance and exceeding customers’ expectations with duty of care and service.

Let’s talk more about your business model and how you (and your customers) will benefit from a new kind of trip coverage.

Request a Call

Reach out to our partnerships team to schedule some time for a quick, no obligation discovery call.

"*" indicates required fields