Your Comprehensive Partnership Guide: Exclusive Access to the Inner-workings of battleface

What is the battleface difference?

We help companies across the globe add more value to their travelers’ experience with hyper-relevant travel protection backed by second to none customer service during all phases of travel. We’re your next partnership that will help you add or increase ancillary revenue and amplify lifetime value with your customers.

The battleface difference, contributed by a few of our partners

Partner Guide: Choose Your Journey

Click the button of the topic you’re most curious about, or, continue scrolling to take your own self-guided tour.

Partner FAQ (Frequently Asked Questions)

What is battleface most known for?

Our name alone makes us stand out – but name aside, product customization, benefit modularity, and obsession over customer experience is what we’re most widely known for in the industry.

Which areas of the business does battleface outsource?

None. While we have strategic partnerships with outside insurance carriers and reinsurers, every aspect of our business model is managed 100% in-house.

Does battleface sell travel insurance policies direct to consumers?

While we do have a DTC (direct-to-consumer) channel for policy distribution, we use this channel as a strategic advantage to benefit our partners. We see our DTC channel as a sandbox type of environment to test and experiment to pass key insights along to our other distribution partners.

Which channels does battleface most actively partner with?

Our partner channel mix is diverse, mainly due to the flexibility behind our technology and broadness of our available products and benefits. Refer to our “who we partner with” page to learn more.

battleface Global Markets

United States Travel Insurance Market

battleface entered the U.S. market strategically to solve for main problems: limited policy customization and subpar, and oftentimes, fragmented customer experiences. We quickly made a name for ourselves, not just because of the name battleface, but the uniqueness of modular travel insurance in the U.S. market.

UK Travel Insurance Market

The battleface brand originally launched in 2016 in the UK market as a Lloyd’s of London cover holder. Nine years later, the brand remains a notable favorite among travellers in the region.

Australia Travel Insurance Market

The Australia market for travel insurance, in general, boasts one of the highest written premium per capita in the world. With a population of ~35M and annual written premium now exceeding $2B, battleface’s 2023 market entry was well timed and has been growing rapidly since.

EU Travel Insurance Market

With over 200 languages spoken, 27 different countries, and seven of those 27 not using the euro, the EU (European Union) market is arguably the most complex to navigate in the world for travel insurance.

Canada Travel Insurance Market

With 10 unique provinces spread across 3.85M square miles of land, the Canada market for travel insurance is also a challenging one to navigate. But with a market size estimate of $543M written premium and population of ~40.1M, it’s comparable to the U.S. in travel insurance premium per capita!

Global, Rest of World

Underwritten by the highly rated carrier, Crum & Forester, battleface offers its partners the opportunity to go-to-market with a unique and competitive global product designed for other rest of world countries outside of U.S., UK, EU, Australia, and Canada.

Single Trip Modular: Unbundled travel protection benefits enabling partners and customers alike to pick and choose only the benefits they want.

Single Trip Bundled Plan: After years of offering a modular plan in the U.S. market, we built a bundled option including the most popular benefits.

Multi Trip Annual: Our fastest growing plan in 2024, designed to meet the needs of frequent travelers. Multiple trips, covered under one annual plan.

Corporate Group: Launched in 2024 in partnership with Crum & Forester, the battleface Corporate Group travel plan in the U.S. is designed to meet the needs of large enterprises or SMBs.

Single Trip Bundled Plan: Designed by UK travellers for UK travellers. This international policy was one of the first launched by battleface and continues to be a popular choice.

Annual Multi Trip: Launched in the UK market early in 2024, this annual policy is loaded with benefits. And, in 2024, the average premium per insured was just £109.

Annual Business Travel: The ideal policy for UK-based SMEs who employ travelling teams. This is the product to watch in 2025 for battleface UK.

Single Trip Modular, International: This was the fastest growing product at battleface in 2024. Australian travellers frequented Southeast Asian countries and opted for this plan in abundance.

Single Trip Modular, Domestic: While the majority of Aussies live on the east side of the country, when they pack up to travel inland or to the west coast, there’s a domestic available.

Multi Trip Annual: The most recent product to launch in Australia is Annual Multi Trip travel protection. This product will inevitably make a big splash in the market in 2025.

Single Trip Bundled Plan (Lloyd’s): EU travellers going outside the EU will have a comprehensive package of benefits with the ability to buy in Euros or Swiss Francs.

Single Trip Bundled Plan (Crum & Forester): Citizens of the EU also have the option to purchase our global plan underwritten by C&F. Policy is packaged with nine essential travel protection benefits.

Annual Business Travel: Introducing the newest product launched in the EU: Annual Business Travel Insurance. The same product offered in the UK is now available in the EU.

Single Trip Bundled Plan: The battleface Canada plan is underwritten by way of a strategic partnership with Crum & Forester’s Canadian carrier. This policy is equipped with packaged benefits designed for Canadians travelling outside the country, specifically to warmer climates in the U.S. and Caribbean.

Single Trip Bundled Plan (Crum & Forester): For the rest of the world (ROW), excluding the U.S., UK, Canada, and Australia, international travellers can purchase the Crum Global policy. In 2024, approx. 50% of these policies were purchased by travellers who had already started their trips, making this a unique offering in the global market.

A competitive advantage

We're most known for helping partners build hyper-relevant plans designed to convert. Reach out and let's schedule a brief intro chat to learn more about your business needs

Travel Assistance Services Powered by Robin Assist

Who or what is Robin Assist, and we thought you said you didn’t outsource?

We don’t! Robin Assist is a wholly owned subsidiary of battleface. We separated our core lines of business into two brands: battleface Insurance Services and Robin Assist Travel Assistance Services.

—

Here’s a visual overview of services offered through Robin Assist

Partnering with battleface was an intuitive choice for us, driven by our admiration for their robust customer service infrastructure, including Robin Assist, and their unwavering dedication to innovation and redefining insurance norms.

- Butter insurance, Australia

Partner Distribution Channels

The battleface origin story dates back to 2018 in the EEA region, inclusive of the UK, offering travel protection to journalists traveling into or around conflict zone areas. “Travel is a battle, put your face on” became the slogan at the time.

While our original direct-to-consumer model enabled us to grow and build a popular global brand, we set out to share our experience and travel protection plans with a broader collection of companies.

Fast forward to present day, our distribution channels are arguably the most diverse in the travel insurance industry.

Here is a short-list of the channels we partner with most frequently

Online Travel Agencies

Whether your the largest OTA in the world or growing a new one, or somewhere in between, adding a new revenue stream with high converting travel insurance plans from battleface will help your traveling customers and bottom line.

Click "Online Travel Agencies" above to Learn more.

TravelTech

Technology working behind the scenes (literally) makes travel possible. Our TravelTech partners have chosen to work with us for many reasons, most notably, our tech platform and modular benefit APIs to enable fast integration and hyper-customized products.

Click "TravelTech" above to learn more.

Managing General Agents

While battleface itself is not a carrier, we've partnered with several highly recognized carriers around the world. These strategic partnerships have enabled us to expand into the MGA market by offering our collection of high-converting products to a broader industry segments.

Click "Managing General Agents" above to learn more.

Travel Management Companies

Organizations that employ a large amount of traveling employees have a lot of coordination and logistics to manage. Insert TMCs. Through their (TMC's) technology, they make booking and managing travel plans easier to manage. And, we partner with them, as well.

Click "Travel Management Companies" above to learn more.

Insurance Comparison

Sites

The global market for aggregator websites is significant and a very popular way for consumers to buy travel protection. While the majority of our aggregator partners are in the U.S. and Australia, we'd love to expand into other regions of the world.

Click "Insurance Comparison Sites" above to learn more.

Seasonal Registrations &

Event Ticketing

Because of our modular benefit API capabilities, we can customize event ticket protection packages for distribution partners in this specific industry. Custom protection benefits available for single ticket, multiple tickets, season tickets, and more!

Click "Seasonal Registrations & Event Ticketing" above to earn more.

Airlines

The airline industry has made opting in for travel protection a simple part of the booking experience. When airlines partner with battleface, not only will the embedded opt in experience be improved, but conversion rates will increase with a more relevant product offering.

Click "Airlines" above to learn more.

Specialty Travel

When you have the ability to unbundle over 46 travel protection benefits, the sky is the limit to customize plans for any type of travel company. For instance, we embed a custom pet travel insurance offer into the booking path for a specific "traveling with dogs" website!

Click "Specialty Travel" above to learn more.

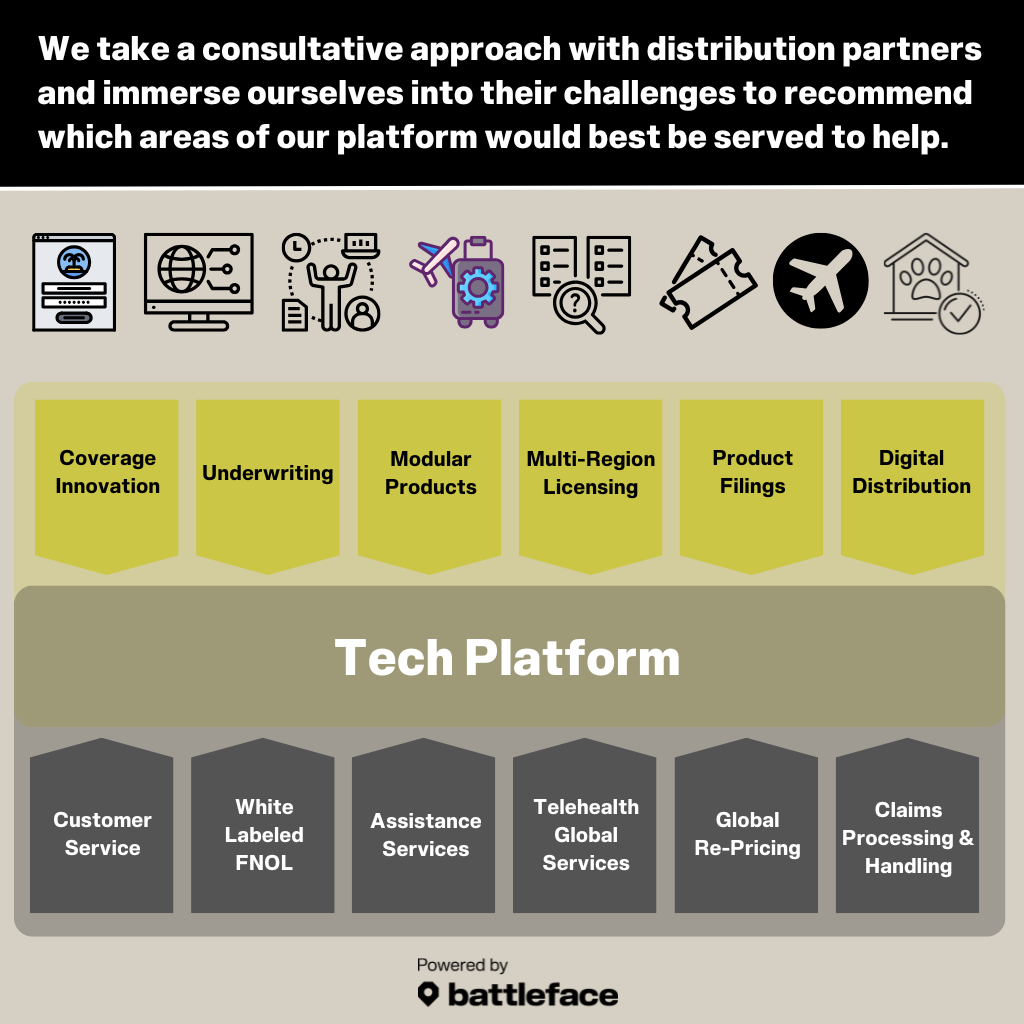

Unifying Travel Insurance and Assistance Services within One Global Tech Platform

What started in 2016 as a singular product offering running on outsourced technology has grown into a global, one platform tech solution for end-to-end policy administration and customer service.

While technology continues to evolve and we enter the AI era, we’re staying one step ahead in the travel insurance industry, providing robust and innovative solutions built for today’s travelers while building for tomorrows.

It's difficult for tech to standout from the crowd in insurance. But here are a few ways we differentiate from others in this industry.

CUSTOM PRODUCT BUILDER

Underwriters have access to create and update products quickly through our no-code product management system which can cater to per state/country rules and regulations.

DOCUMENT MANAGEMENT

Users can easily build and update dynamic fulfillment documents according to product, partner, state and country directly within of the tech platform.

INSTANT API

Once the product is published it is immediately available through our API, allowing for instant integration. Our main differentiator here is speed to market.

UNBUNDLED BENEFITS

Product and service features are built in a modular fashion where benefits can be sold on their own or packaged together, enabled by flexible and instant APIs.

HYPER-TARGETED

Partners can use any combination of benefit modules within a product to target specific types of travel or demographics, thus creating “micro- products” through the API.

FULL SERVICE

Managing the customer experience with a fully internal operation from product filing, customer service, travel assistance, and claims processing and handling.

One Platform Solution, Visualized

Dynamic Ecommerce Solutions Designed to Convert

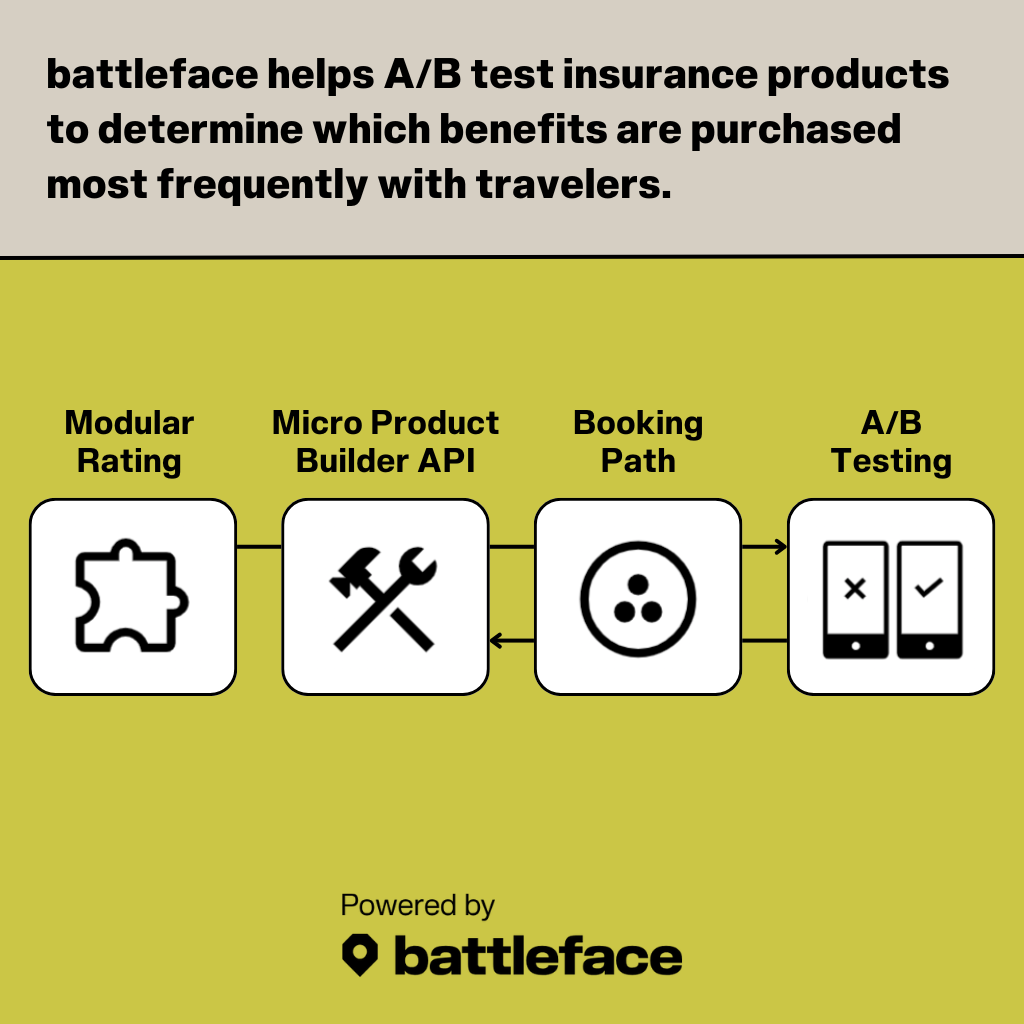

In the world of ecommerce, the challenge for any company is, “how can I optimize for conversion in the most efficient way possible?”

While abstract on the surface, we have a strong belief, backed by years of research and testing, in four core ecommerce principles:

- Product relevance combined with offer timing will stand the test of time.

- Freedom of choice is a competitive advantage, not a conversion detractor.

- You can’t go wrong with authentic and relevant social proof and trust signaling at time of purchase.

- The best chance to build repeat buyers and lifetime value is derived from the experience after the purchase.

The optimal choice for conversions and long term profitability: Embedded Insurance

battleface: built for today's travelers and building for tomorrow's.

If you’ve made it this far …

You have learned a lot about partnering with battleface! Let’s schedule a quick call to learn more about YOU and what problems we can help you solve.